Sector 1 Farming & Agroforestry:

Abundant opportunities;

Agriculture is Africa’s largest economic sector, representing 15 percent of the continent’s total GDP, earning more than $100 billion annually. It is highly concentrated, with Egypt and Nigeria alone accounting for one-third of total agricultural output and the top ten African countries, generating 75 percent of the continents production.

Africa’s agro-ecological potential is massively larger than its current output, however, so are its food requirements. While more than one-quarter of the world’s arable land lies in this continent, it generates only 10 percent of global agricultural output. So there is huge potential for growth in a sector now expanding only moderately, at a rate of 2 to 5 percent a year.

However, four main challenges inhibit the faster growth of agricultural output in Africa;

With 85 percent of Africa’s farms occupying less than two hectares, production is highly fragmented. Therefore, new industry ‘subsistence farming’ models that allow small farms to gain the benefits of scale are required (our Hub being fed from our ‘subsistence farmer’ spokes).

A successful agricultural system requires reliable access to financing, as well as high-quality seeds, fertilizer, water and innovative farming techniques (agroforestry). Other essentials include access to robust markets that could absorb the higher level of agricultural output, a solid postharvest value chain (our Fair Trade connection) for the output of farmers, and programs to train them in best practices (our entrepreneurial programme) so that they can raise productivity. Africa has diverse agro-ecological conditions, so countries need to adopt many different farming models to create an African green revolution.

To make the agricultural system work better, experts estimate, sub-Saharan Africa alone requires additional annual investments of as much as $50 billion (our Proposals require minimum investment and feature our entrepreneurism training to be aligned to the 3 existing resources – Land, Farmers and an untapped labour force of women and young people). African agriculture therefore needs business models (our market Hub clusters supported by bi-product industries such as milling, grinding, packaging, canning etc, etc.) that can significantly increase the level of interest and investment from the private and public sectors, as well as donors.

A successful agricultural transformation requires some basics to be in place—transportation and other kinds of infrastructure, stable business and economic conditions, and trained business and scientific talent. Many African countries are making great strides in laying the groundwork, but others are lagging behind. Our fit for purpose model is cost effective, proven and is massively fit for purpose.

We at AFS provide real, cost effective and deliverable solutions to introduce such sustainable transformation and in particular, recognise three significant opportunities. The first is developing our technological farming breakthroughs which deliver high returns on investment and could sustainably raise small farmers from poverty. Our innovative farming techniques increasing harvests and yields by a factor of 6 to 10 times existing production levels. Second, introduce new value chain ‘Hub’ approaches which are Fair Trade linked and aimed to improve access to markets and help groups of farmers raise their productivity. The third opportunity is the development of suitable, identified and selected large tracts of high-potential agricultural land.

Our farm production programme is targeted and directed towards servicing the specific demand from our Fair Trade partners’ advice and their produce requests, which are pre-ordered to ensure ready markets for farmers’ produce.

Sector 2 Banking and Financial Services

Growth

Fully 2.5 billion of the world’s adults don’t use banks or microfinance institutions to save or borrow money, but unserved doesn’t mean that they are ‘un-servable’. A vast new strata of new customers awaits the Banks who are prepared to embrace and service the emerging population of customers. Acknowledging this, Africa’s banking sector has grown rapidly in the last decade and Sub-Saharan Africa has become a substantial player in emerging-market banking. The financial sector is outgrowing GDP in most of the continent’s main markets. Financial reforms have largely enabled this growth. Nigerian banking reform promoted a swift consolidation (from 89 to 25 banks between 2004 and 2006) that unlocked the sector’s potential—providing bigger banks with better capabilities to drive down their costs which allows them to penetrate a larger portion of the unbanked population and to ride on the back of prospects for rapid economic growth. This is now linked central-bank and governor initiated reforms, designed to increase accountability and transparency.

M&A activity has also improved productivity, as smaller, less-efficient institutions are being acquired by larger ones. Many M&A disappointments however are down to failures of engaging experienced M&A experts from ‘conceptual’ day 1 and from failings in employee or management integration due to a lack of due diligence expertise in this specific facet of creating emergent corporate flow, profit forecasts, market share and management effectiveness.

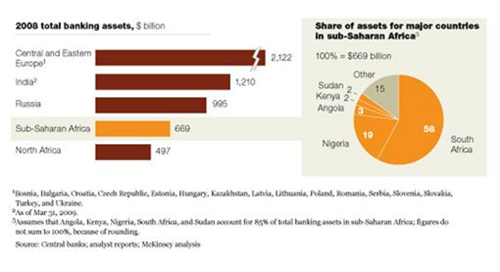

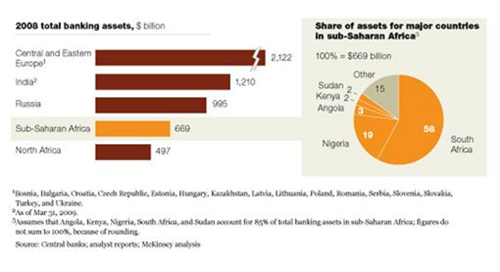

Sub-Saharan Africa has become a substantial player in emerging-market banking

Current and Future Landscape insights

>Geographic banking expansion throughout Africa and the creation of new segment markets embracing affordability, improved accessibility, efficiency and customer friendly services, provide new and exciting areas of opportunity. In addition, product innovation (filling the gap between traditional banks and micro-lenders), selling additional products to meet clients’ evolving needs, mobile banking advancements (e.g. - Kenya’s M-Pesa) and expanding banking value chains through embracing corporate and investment banking services, all now provide additional growth areas of opportunity for AFS involvement.

Corporate Risk, Mergers & Acquisitions

Banks are no different from other commercial Corporations who are in business to grow and earn profits for their shareholders. In emerging markets such as in contemporary Africa, dynamic Banking companies can steal a march on competitors by significantly outgrowing and out performing their competitors. Whatever the business, sector or organisation however, it is inevitable that mere organic growth cannot provide the level of expansion or momenturequired to achieve the necessary dynamic and successful breakthrough in performance. Growth will inevitably come from expansion through mergers and acquisitions. Therein however, lies a trap for the ill-prepared and unready.

AFS fully comprehends this entire M&A life-cycle and can provide expert analysis and commercial advice and nurturing during this integration process. AFS emphasises the importance of conducting comprehensive due diligence during this time and as a unique selling point, especially in the mostly unattended field of Executive and employee due diligence.

This is an area of our management competence which distinguishes AFS from our competitors and which enables us to provide our clients with salient insights into the compatibility of M&A participants and mitigates risks and pitfalls. It also enable Banks to assess whether their staff and processes are ‘fit for everyday purpose’ and helps clear staff ‘bottlenecks’ and identify unrecognised leaders and exemplary staff ‘champions’. Assessing people skills is a must have ‘audit and performance measurement tool’ for enterprising and ambitious Banks.

We at AFS recognise that corporate risk refers to the exposure from an extensive range of liabilities and dangers. This is however the accepted and understood everyday ‘ying and yang’ of embarking upon commercial endeavours which any business faces. However, if risk can be mitigated and managed, then the rewards from pursuing an expertly run and robust M&A growth strategy can be substantial and deliver long term corporate success

Sector 3 Telecommunications

Our AFS Team, working with our expert consultant partners, have carefully considered the African technology sectors and we have identified sector “sweet spots” which are ripe for investment development in the African marketplace.

We are ready to capitalise on the fact that the ‘Telecommunications’ market is increasingly competitive, and world-class local enterprises are emerging in voice and data services. Telecom revenues have increased at a compound annual growth rate (CAGR) of 40 percent, and the number of subscribers rapidly exceeded 400 million. To meet the increased demand, investment in telecom infrastructure—about $15 billion a year—has also grown massively. We further recognise that about 50 percent of the growth in ‘voice’ will come from rural areas.

We also recognise that social welfare in Africa is also improving. Many small-boat fishermen in Senegal, for example, now use mobile-data services to select the best ports for unloading their catch each morning, increasing their sales by 30%. Improving uptake and development of such as mobile health care ‘Apps’ will also provide significant benefits, helping governments to stretch thin resources further. 80 percent of health care issues can be resolved by mobile phone, at a cost per capita that is 90 percent lower than that of traditional health care models. Indeed, very poor people in emerging economies not only have a surprising degree of interest in financial service applications on their mobiles but also, when and where possible, use them enthusiastically. In fact, mobile phone penetration is exploding in Africa. For example the M-Pesa system, Vodacom’s widely used mobile money platform—invented in Kenya—allows users to deposit, withdraw, and transfer money with a mobile device. M-Pesa continues to gain ground not only in Africa but also in the rest of the world: In a remarkable example of reverse innovation, it is now penetrating the US and EU markets. Accordingly, we strongly recommend the inclusion of the following of our technologically exciting and rich innovative ‘AFS versions’ of disciplines for investment consideration:

- Off Grid (Rural) Power/Energy Solutions (Solar/Wind/Biomass, etc.)

- Tax Revenue Collection Systems (Key Stakeholders: Governments)

- Revenue/Tax Assurance Systems for Telco (Key Stakeholders: Governments)

- Affordable Mobile Broadband/Voice (e.g. using Wi-Fi over TV bands and/or low cost 2G/4G): All sectors but Oil & Gas, Education, Government, Agriculture and Health are key

- Big Data & Cloud Services for Telcos

- Mobile Financial Services

- Training & Capacity Building (TMT all areas)

- Radio/Spectrum/TV Licensing & Digital Switch Over of TV

- Content & Advertising Industry Growth

- Cost-effective Technology Project Delivery Services: fibre, mobile systems, etc.

This preceding list all derives from frontline work we are currently undertaking across contemporary Africa. Our strategic imperative is to generate telecommunication revenues. Our proposed model can develop a business to provide a professional service offering to our Investing Partner and through them to legal and accounting firms and similar sector participants based on a technology assessment and advisory capability, which leverages one of our core strengths, our technology understanding and expertise.

Current and Future Telecommunications landscape

Many ‘start up’ African ventures have struggled to deliver their products and services in what have been in recent years, very turbulent and difficult market conditions. In many cases, the perceived demand has not in fact materialised. Professional services companies, in particular, the big five, offer due diligence services and strategic management consulting to investment firms. Their analysis and advice is not aligned with the interests of the investor because their business model is diametrically opposite. While investment firms seek growth in value of the portfolio, the big five need to sell man-days

We have the capability internally to offer and reflect an Investors viewpoint when providing assessment and advisory services to investment companies. The specific area we are focussing on is technology assessment, technology strategy and implementation services.

The premise being:

- Many technology companies still have significant cash resources.

- Many technology companies have not delivered fully functioning technology.

- Investors know they are carrying un-realised capital losses.

- Many investors do not know whether: a. the technology will be delivered or at what cost and when; b. there remains a viable market for the technology.

- Many investors do not have a sense of the market price for technology and technology consultants & developers.

- Many investors are considering whether to cut their losses or continue with the business model.

Our Telecommunications service offers three discrete packages of work:

- Assessment – members of the technology team will undertake a detailed technology assessment and due diligence exercise and provide a detailed written report on the state of the technology within a venture.

- Advice – On completion of the assessment work package, the team would provide an analysis of the strategic options open to the client for their future engagement with the venture and recommend the most commercially beneficial course of action.

- Action – We can provide a wide range of follow on services to support the venture or client in the execution of the recommended strategy. This would include services from technology, corporate finance or strategic consulting professionals within the firm.

We have the capacity to provide a technology due diligence service to assess:

- Whether the technology is working;

- How long will it take to get the technology to market?

- At what cost will it take to get the technology to market?

- Whether current cost structures are appropriate;

- Whether a viable market remains for the technology.

We can then advise the investor(s) (or company’s board of directors) on, and in certain circumstances support, courses of action such as:

- Continue or discontinue existing technology development;

- Make changes to management and execution of the technology development (which we could support);

- Propose outsourcing of coding work to lower cost providers;

- Propose market development activities.

- Propose corporate finance activities.

- Propose additional capital raising.

Sector 4 Oil, Gas - and Unconventional Energy

New sources of growth

African oil and gas have become important components of the world’s hydrocarbon supply–demand balance. Through 2015, 13 percent of global oil production will take place in Africa, compared with 9 percent in 1998 - a 5 percent compound annual growth rate (CAGR). African oil projects have attracted substantial investment thanks to their cost competitiveness versus those in other regions.

What’s more, the oil and gas sector is a foundational element of economic growth for the continent, as 19 African countries are significant producers. It accounts for a significant part of the state’s revenues there and represents a prime mover for employment, domestic power development, and, in many cases, infrastructure development (for instance, schools, hospitals, and roads).

The sources of growth in oil and gas are evolving. In the past decade, production increases came primarily from deep-water oil in Angola and Nigeria, along with new sources in countries such as Chad and Sudan, as well as offshore gas in Egypt. Production of deep-water oil will continue to grow (in the Gulf of Guinea, for example), while onshore gas and new-resource development in emerging East African hydrocarbon producers (such as Uganda) are expected to become the other main engines for growth.

International oil companies as a group have fared well in Africa, as the licensing of acreage and M&A gave them access to valuable properties. These companies have also moved expeditiously into the new, technically complex frontiers of liquid natural gas, deep-water oil, and underdeveloped countries (Chad, for example). Superior operating capabilities and financial muscle continue to give the internationals a competitive advantage in Africa; however, sustained growth has eluded those that acquired little and mainly operated more mature fields or had operations in countries with geopolitical and security risks.

Large and growing

In recent years, oil production has grown more rapidly in Africa than in any other region, while the production of gas has increased more rapidly in Africa than anywhere but the Middle East. In recent years, innovative and alternative energy competitors have entered and grown in Africa, once the domain of the large international oil companies. Smaller independent oil companies (such as Addax, Heritage Oil, and Tullow Oil) have made successful finds in emerging basins. National oil companies from outside Africa, including China (CNPC, CNOOC and Sinopec), Malaysia (Petronas), and Russia (Gazprom) have also aggressively invested in the continent, linking broader infrastructure investments and government-to-government relationships with access to resources. The challenge for these competitors in the years ahead however, will be to build sustainable enterprises and local capabilities beyond the scope of an individual project or investment.

As for countries which host oil and gas operations, we expect them to continue to offer international and national oil companies alike, an attractive investment environment, which ought to foster competition for natural resources, encourage greater efficiency in the oil and gas sector and in the building of sustainable capabilities. Enterprising governments should also focus on new ways to leverage their resource sectors to capture the economic multiplier of broader GDP growth—for example, by using oil and gas as the catalyst for downstream energy (such as power stations, refineries, and retail outlets) and related industrial development (petrochemicals and basic materials). AFS are already pursing such initiatives with two major exporting energy nations so as to add value to their industry and improve economic return.

Our AFS expertise and direction, constantly emphasises our drive to deliver business growth and in determining innovative strategies to maximise commercial success in the ever changing and challenging Oil and Gas sector. This is extremely apt in today’s market where the price per barrel has reduced dramatically and where our fresh thinking and strategic technical and commercial nous, still discovers and identifies enterprising investment opportunities. This enables our Team to think beyond the immediate solution, anticipate alternative scenarios and solutions and thus enables us to maximise field potential. The added advantage being that the projects introduced by our Team are not offered in the competitive market but are instead offered exclusively to AFS and then through our Investment Partner to our SDV. Under our Expert Team’s supervision and advice, we have assembled an exclusive group of ambitious Oil, Gas and Energy professional contractors who are fully integrated and skilled subsurface experts and are now designated as preferred suppliers to African Forum Scotland and as such to any new special delivery vehicle (SDV), set up in joint association with prospective Investment Partners. Our Team covers the entire spectrum of both Upstream and Downstream projects within the Oil & Gas sector and are especially well set up to capitalise on developing the Marginal and Mature Fields arena where our expertise covers a life cycle of Oil delivery from Reservoir Engineering, whereby we identify and assess the best process of delivering maximum barrelage extraction from fresh, apparently obsolete or underperforming Oil Fields. Our Reservoir teams also include geoscience experts, support and process engineering consultants and geo-mechanical professionals.

We are also associated and teamed with prominent engineering procurement and construction (EPC) contractors and with an Exploration and Production company which has a strong relationship and extensive experience of successful oil extraction within Sub Saharan Africa. Our strength is further enhanced by our association with High Net Worth individuals and Energy Investors seeking to develop Marginal and Mature Fields and with interest in the identification and association with other African joint venture Partners. We are also competent in the delivery of unconventional energy supplies including geo-thermal, solar, hydroelectric and UCG

Sector 5 Mining

Unearthing Africa’s potential

Africa’s mining sector presents a paradox: although the continent is strongly endowed with mineral resources, mining has not been the consistent engine of economic development that people in many countries have hoped for. Nor, to date, has Africa attracted a share of global mining investment commensurate with its share of global resources. Unlike the output of most economic sectors (though like oil and gas), most minerals are globally traded. Global demand is therefore driven primarily by the needs of developed nations and the pace of growth in a few large developing countries. What’s more, mining areas in Africa compete with those elsewhere for development funding. From a growth perspective, the question facing the sector is thus whether and how Africa can make its full potential contribution to satisfying the world’s ever-growing need for mineral resources and capture wider socioeconomic benefits from their development.

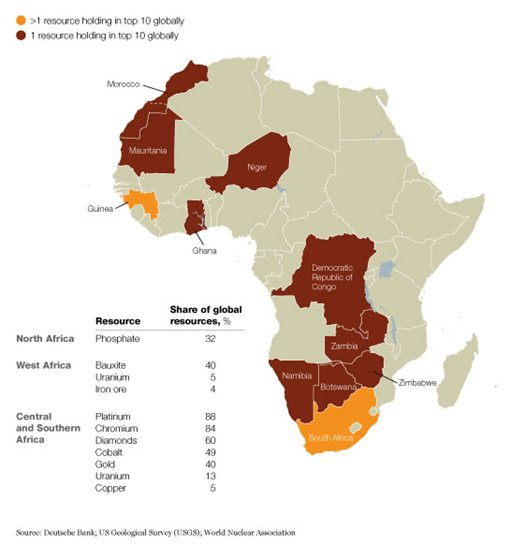

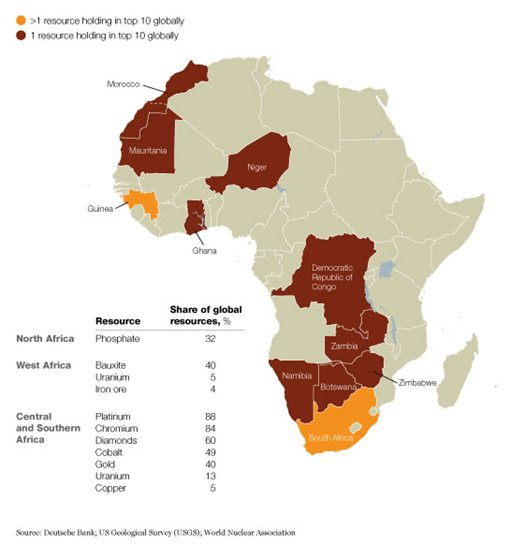

Many parts of Africa have long been known to be rich in mineral resources. Eleven of its countries, especially in southern and western Africa, rank among the top ten sources for at least one major mineral. The continent has a majority of the world’s known resources of platinum, chromium, and diamonds, as well as a large share of the world’s bauxite, cobalt, gold, phosphate, and uranium deposits. The development of these resources has faced more significant challenges, however, when compared with the experience of more developed mineral-rich countries, such as Australia or Chile. Even outside well-publicized conflict zones, many African countries have been thought to pose high political and economic risks for investors. Furthermore, infrastructure problems often hinder development: many bulk mineral deposits require multibillion-dollar investments in rail and port facilities to allow ore or semi-processed minerals to reach their markets. Such investment decisions are not taken lightly, especially for less stable countries where the rule of law and security of tenure are not necessarily guaranteed.

Largely as a result, Africa’s pattern of mining investment differs from that in other regions of the world. Of the five largest global diversified mining companies, only one has a major share of its production in Africa. With the diversified majors relatively quiet, junior mining companies and major ones focused on diamonds and precious metals have played a significant role in developing the continent’s resources. In recent years, newer players, such as Chinese and Indian companies, have entered the scene, but few projects have been developed to the point of production.

The recent financial and economic crisis has hit the global mining industry hard—and Africa at least as severely as other regions. Commodity prices slumped by 60 to 70 percent in late 2008, although they have since recovered considerably. There is now less appetite for the relatively high risk that usually comes with mining in many African countries. Despite the recent market turbulence, most observers expect demand for major mined commodities to grow strongly in the next 10 to 20 years, to support increased urbanization and infrastructure build-out in China and the emergence of India’s middle class. Africa, given its share of global resources, will surely play a significant part in meeting that demand.

Rich in resources

Eleven African countries are among the top ten global resource countries in at least one major mineral.

For mining companies and investors, the economic crisis has taken the froth out of the market. But it hasn’t fundamentally changed many of the factors that will shape long-term investment decisions, including political and economic stability, taxation regimes, and the availability of infrastructure. Nor, of course, has it changed the underlying geology. Lower commodity prices and stock market valuations have shifted the “build or buy” balance between in-house exploration and development, on the one hand, and mergers and acquisitions, on the other. If valuations continue to recover, this window of opportunity may be short-lived.

Over the longer term, international companies considering investments in Africa will need to spend time and energy to gain a deeper understanding of the unique challenges of every African country. They should learn from the success stories of other players, assess risk comprehensively, and determine the role each country will play in their portfolios. Mining projects will need to include the broader socioeconomic-development programs that have been commonplace in petroleum for many years. In many cases, these programs will be achieved through partnerships between mining companies and other parties, which will provide financing and infrastructure development.

Africa’s governments will play a major role in shaping the future environment. In recent years, governments have expressed frustration about the way the continent’s resource endowment hasn’t translated into economic development. The African Union and the UN Economic Commission for Africa (UNECA) have developed the African Mining Vision 2050, which sets out a number of ideas for increasing the resource wealth flowing to the nations that host mining operations. Some of these ideas would transfer wealth from mining companies to governments—for example, by making the auctioning of exploration rights more effective and linking taxation to commodity prices more closely. Others, such as the better management of resource income and the active development of the supply and infrastructure sectors, aim to create a more favourable environment for economic development.

AFS mining opportunities

AFS are currently working with 3 Sub Saharan mineral enriched Nations to help them develop their mining industries.

This includes engaging our technical experts to help them review and formalise fit for purpose ‘regulatory’ procedures, identify then embrace cutting edge and effective extraction techniques and to improve capacity building models, which reflect our management Techniques and Tools.

Our brief will also include community engagement improvements and Training programmes to increase employment sourcing from localities surrounding the mining operations. This training will include enhance the promise and talents of front line workers through to management Executives.

Joint Ventures featuring equity participation for AFS, our technical Teams and prospective Investing Partners will be offered for mutual consideration and benefit.